Diminishing balance formula

Diminishing Balance Method signifie Diminution de la méthode du solde. Straight-Line Depreciation Percent 100.

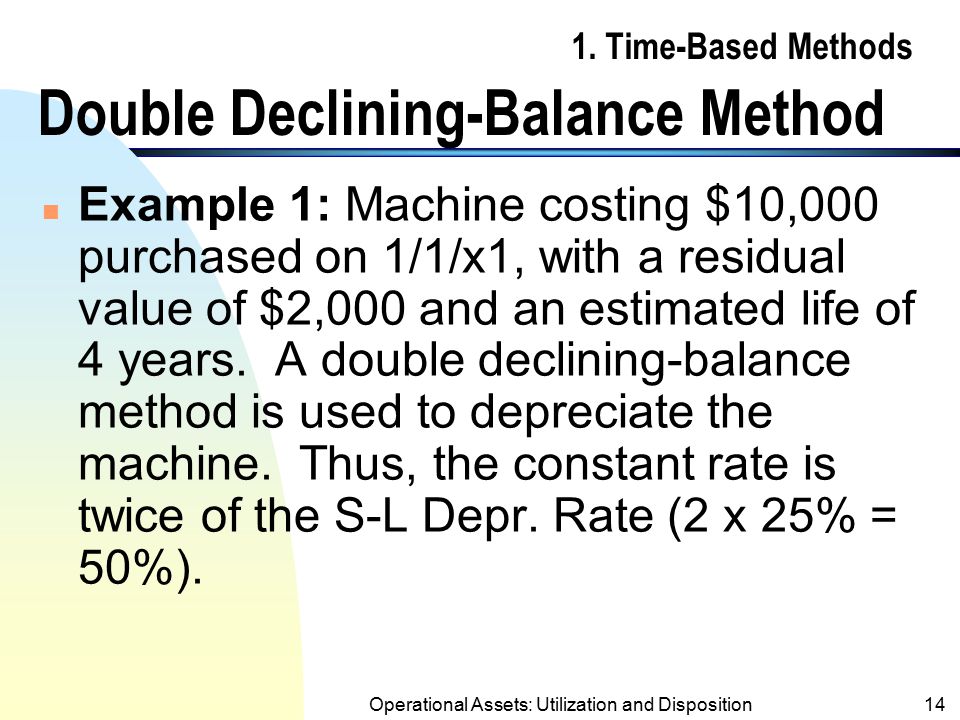

Double Declining Balance Method Of Depreciation Accounting Corner

What is the formula for diminishing balance.

. In this lesson we explain what the straight line and diminishing balance depreciation methods are show the formula for calculating the depreciation methods. Subtract the total scrap value from the total asset cost. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

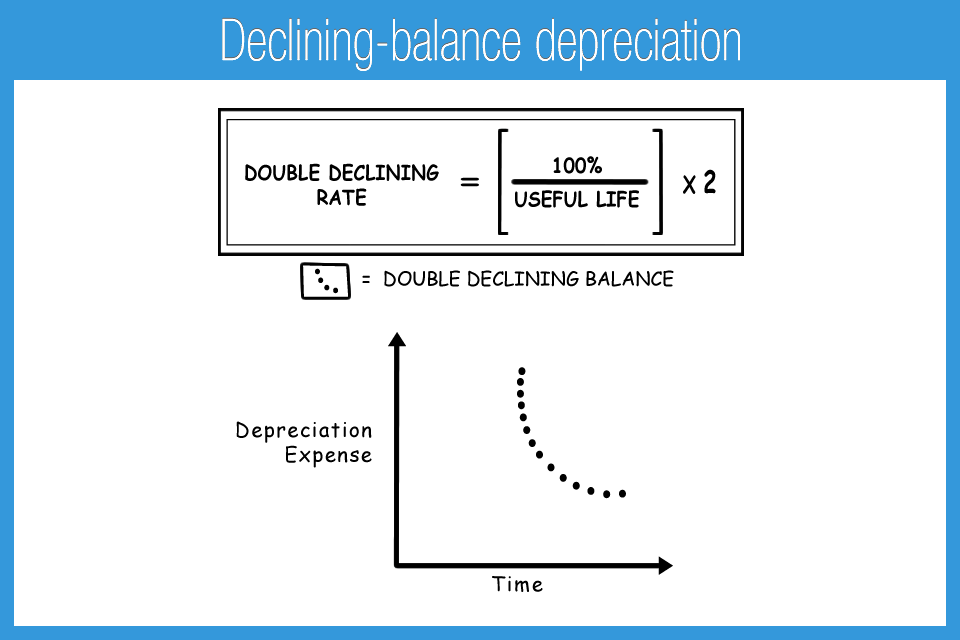

Declining Balance Method. The formula to calculate depreciation value using the diminishing balance method is as follows. Things to note in the above calculation.

Depreciation amount opening balance depreciation rate. 2000 - 500 x 30 percent 450 Year 2. The Diminishing Balance method is easy to calculate as it only requires the depreciation rate and the net.

Diminishing Balance Method Cost of an Asset Rate of Depreciation100 Unit of Product Method Cost of an Asset Salvage Value Useful life in the form of Units Produced. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non. The basic formula for calculating the rate of depreciation to be used in the diminishing balance method is.

Closing balance opening balance depreciation amount. Depreciation by Diminishing Balance Method On 1st Jan. But on downside this.

In Diminishing Balance Interest Rate method interest is calculated every month on the outstanding loan balance as reduced by the principal repayment every month. 10000 Thus the value of the equipment is diminished by Rs 10000 and becomes Rs 90000. The rate of Depreciation 10 Year ending 31 March.

The diminishing balance method of depreciation or as it is also known the reducing balance. Advantages of Diminishing Balance Method. Multiply the whole book value by maintaining the depreciation rate.

2003 machinery was purchased for Rs 80000. What is the Formula for Calculating Depreciation Value using the Diminishing Balance Method. F i r s t y e a r d e p r e c i a t i o n c h a r g e 100000 10 R s.

The total interest payable calculation is simple. N number of year of. When declining balance method does not fully depreciate an asset by the end of its life variable declining balance method might be used instead.

The various methods of depreciation are based on a formula. The loan calculations will be as below. R 1 n SC x 100.

Where r the rate of depreciation. So Total Cost of an asset 110000015000050000 Rs 1300000- The following table shows the year by. Diminishing Balance Method est un terme anglais couramment utilisé dans les domaines de léconomie.

Diminishing balance method of depreciation is most suited to plant and machinery where additions and extensions take place so often and where the question of repairs is also very. 2004 additions were made to the machinery of Rs.

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Depreciation Daily Business

Declining Balance Method Definition India Dictionary

Double Declining Balance Depreciation Method Youtube

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Depreciation Formula Calculate Depreciation Expense

What Is The Double Declining Balance Ddb Method Of Depreciation

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Method Of Depreciation Formula Depreciation Guru

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Profitable Method Declining Balance Depreciation

Double Declining Balance Depreciation Calculator

How To Calculate Declining Balance In Excel Using Formula

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting